All articles by Adrian Murdoch

Australia’s Coles sets trio of goals for sustainability-linked loan

The landmark financing deal from the country’s biggest supermarket chain aims to reduce both waste and emissions and put more women in leadership roles. Capital Monitor speaks to Coles’ treasurer and CFO as well as bankers on the deal.

Dubai: Landmark sustainability-linked loan targets gender diversity

Hotel and shopping mall group Majid Al Futtaim will use the proceeds from its new $1.5bn sustainability-linked loan to target emissions, green malls and, in a first for the Middle East, gender inequality. Head of treasury John Arentz provides the details.

US solar sees brighter prospects as Sunnova issues first green bond

America’s solar industry has faced challenges getting financing, but investor and public sentiment is improving and government support is growing. A $400m debt issue last month was another positive sign.

Burberry’s sustainability strategy: Why Scope 3 and sourcing are key

The British luxury fashion house was the first of its peers to tap the sustainability bond market. A year on, it has not only met its targets but in some cases gone beyond them. The company’s CFO and head of corporate responsibility explain how.

A look inside Asia’s first green commercial paper guarantee

Green short-term funding has struggled to take off as an asset class. With Asia’s first green commercial paper guarantee for Taiwan’s Sing Da Marine Structure, Crédit Agricole hopes that a new wind is blowing.

Why Côte d’Ivoire’s first green bond is so important

The private placement from shopping centre operator Emergence Plaza had the advantage of a beneficial economic backdrop and high market liquidity. There is much for potential issuers to learn from only the fourth green corporate bond from sub-Saharan Africa.

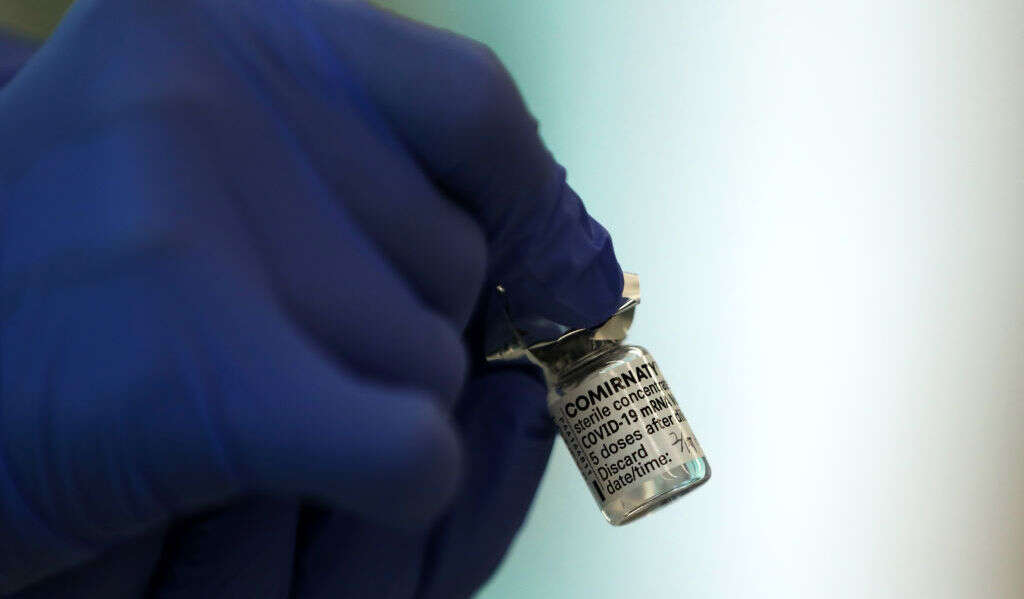

Japan’s young sustainable loan market gets healthcare booster

Medical device maker Nipro has become a rare Japanese issuer of a sustainability-linked loan, and the first from the healthcare sector. Disclosed details are limited, but it aims to use the proceeds to help address Covid-19 issues and generally improve public health both domestically and overseas.

Why are the capital markets still supporting South Korea’s coal habit?

Despite Seoul’s commitment to reducing the country’s reliance on fossil fuels, new coal-fired power projects are still raising funds. But the commodity’s recent sharp price rise may focus the minds of corporate executives, bankers and government officials.

Valeo’s landmark sustainability-linked bond sets auto sector pace

Some car manufacturers have sold green bonds, but Paris-based Valeo is Europe’s first automotive sector company to target carbon emission reduction along the entire manufacturing chain.

Europe’s healthcare sector (finally) warms to green finance

The region’s healthcare providers have been slow to embrace sustainable funding because it is tricky to set measurable key performance indicators in the sector – but that is changing.