All articles by Adrian Murdoch

Hong Kong reit extends green strategy with urban farm plan

Fortune Real Estate Investment Trust has signed a sustainability-linked interest rate swap tied to a farm on top of a mall, adding to its three sustainability-linked loans and setting a positive example in a territory and sector not famed for their green credentials.

Home Credit extends financial education drive with first ESG loan

As part of a push to improve financial literacy, the Czech consumer credit provider has linked the first ESG loan it has taken out globally – in the Philippines’ sustainable debt market – to that goal. Jean Lafontaine, head of funding, treasury, M&A and investor relations, gives the lowdown.

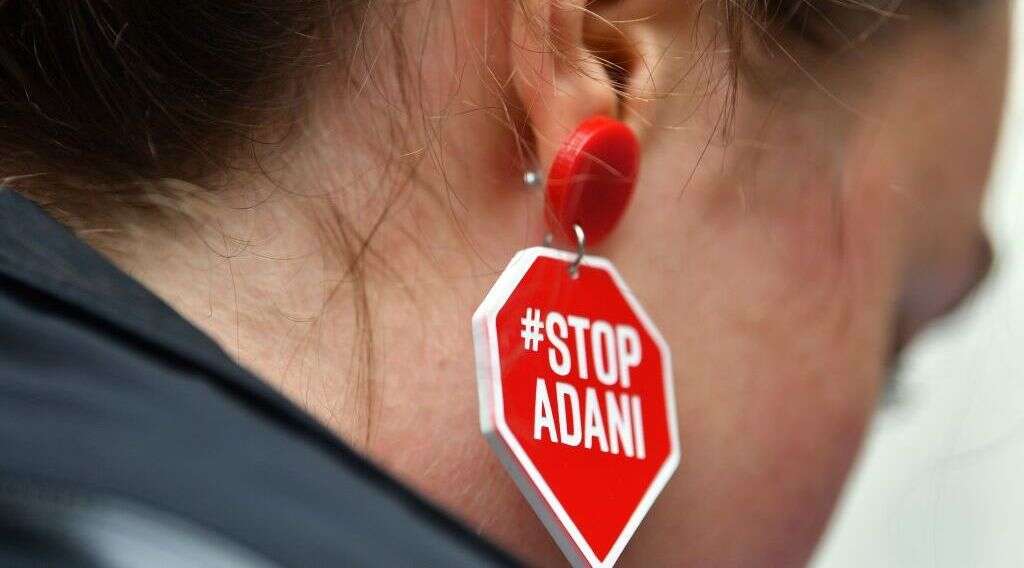

Market’s love for Adani belies coal sector challenges

India’s Adani Group, the world’s largest private developer of fossil fuels, is still securing funding for its Carmichael project in Australia despite investors increasingly withdrawing support and rising negative sentiment against coal. But how long will it be able to do so?

Progressive cement sector faces China challenge in cutting carbon

Cement is the first heavy industry to set net-zero emissions targets and wants to see regulation, including a carbon tax, to help achieve those goals. But there are major challenges, including that pollution levels from China’s cement sector – the world’s biggest – are rising.

How a supermarket giant grapples with ESG data challenge

A corporate treasurer’s work has historically revolved around cash flow forecasts, but increasingly involves defining sustainability key performance indicators and monitoring ESG data. Miguel Silva Gonzalez of Dutch supermarket giant Ahold Delhaize gives his take.

The lowdown on NTU’s landmark sustainability-linked bond

Singapore’s Nanyang Technological University has sold a bond that is only the second of its kind globally. If it misses its targets, the step-up money will go into climate research or carbon offsets, not to investors. Capital Monitor gets the skinny from NTU finance chief Ong Eng Hock.

Universities are waking up to green finance, but say it quietly…

Often cash-flush and shy of scrutiny, higher education institutions have not typically felt the need or inclination to raise green bonds, despite their suitability for such funding. That is changing, with private placements seen as increasingly popular.

Why consumers get suckered by greenwashing

Despite their good intentions, customers are misled by the marketing and brand power of big companies when they try to shop sustainably. Regulators are taking note.

Boardroom pay not reflecting soaring demand for ESG skills

Sustainability expertise has become a key priority for corporate boards in Europe but the sharp rise in demand for ESG-focused top-level executives has not driven an equivalent jump in pay, say recruiters.

European companies “paying lip service” to carbon emissions

Three-quarters of European companies have set emission-reduction goals, but details of how they intend to achieve them are lacking, while only one in ten is on track to hit net-zero targets, finds recent research. Pressure is growing on corporates – and regulators – to take more action.