All articles by Adrian Murdoch

Japan’s young sustainable loan market gets healthcare booster

Medical device maker Nipro has become a rare Japanese issuer of a sustainability-linked loan, and the first from the healthcare sector. Disclosed details are limited, but it aims to use the proceeds to help address Covid-19 issues and generally improve public health both domestically and overseas.

Why are the capital markets still supporting South Korea’s coal habit?

Despite Seoul’s commitment to reducing the country’s reliance on fossil fuels, new coal-fired power projects are still raising funds. But the commodity’s recent sharp price rise may focus the minds of corporate executives, bankers and government officials.

Valeo’s landmark sustainability-linked bond sets auto sector pace

Some car manufacturers have sold green bonds, but Paris-based Valeo is Europe’s first automotive sector company to target carbon emission reduction along the entire manufacturing chain.

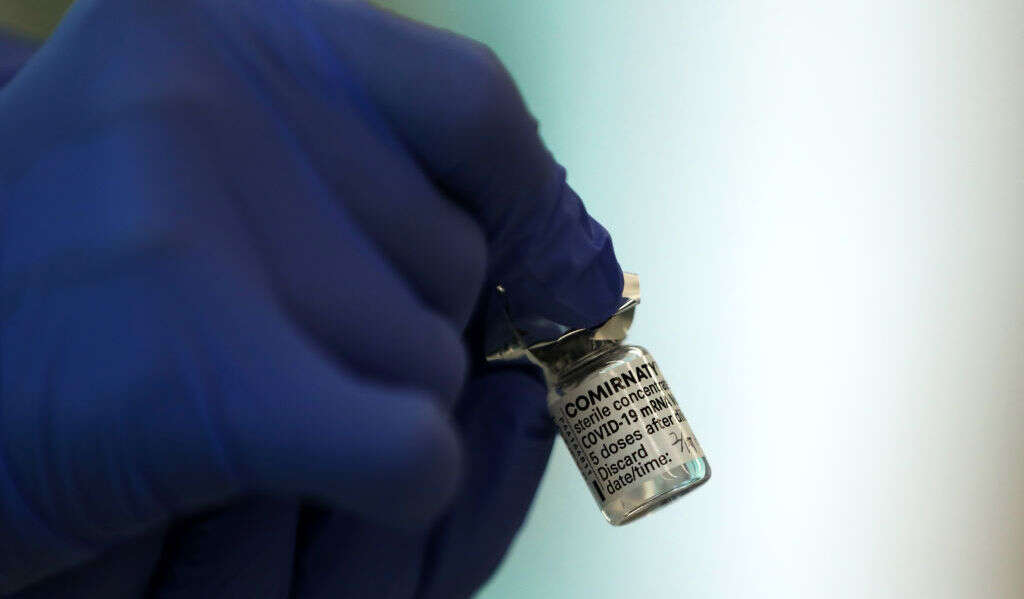

Europe’s healthcare sector (finally) warms to green finance

The region’s healthcare providers have been slow to embrace sustainable funding because it is tricky to set measurable key performance indicators in the sector – but that is changing.

Bond “greenium” shows no sign of vanishing

CFOs and treasurers take note. Although the pricing advantage for sustainable bonds has declined over the past six months, it is unlikely to vanish even as the volume of green bonds rises. Whether this is the case over a longer distance is up for fierce debate.

White goods giant targets tricky Scope 3 emissions cuts

Turkish manufacturer Arçelik will use proceeds from its debut green bond to address a challenge most companies prefer to ignore. The issue attracted strong investor demand despite domestic economic turbulence.

Why Enel’s record-breaking sustainability-linked bond matters

The Italian power company recently sold the largest-ever sustainability-linked bond, after issuing the world’s first in 2019. It also has ambitious plans to cut emissions, add renewables capacity, and raise more sustainable funding.

How Air Liquide beat shrinking ‘greenium’ with compelling debt deal

The French industrial gas producer achieved a record price for its first green debt issue even as the bond ‘greenium’ has narrowed. This is at least partly thanks to the company’s rising focus on hydrogen.

How a French property firm turned its €5.6bn of debt green

Real estate investment trust Gecina has completed the landmark green conversion of its entire debt portfolio. Finance head Nicolas Dutreuil explains the rationale and process of the first restructuring of its type in the property sector.

Why UK firms are falling short on tackling modern slavery

Thousands of British companies that are required by law to produce a statement on this issue have not done so. But some, such as fashion retailer Asos and hotel group IHG, are setting better examples.