All articles by daniel flatt

Sustainable Impact Banking Awards winners announced!

Capital Monitor is very pleased to announce the winners of our inaugural Sustainable Impact Banking Awards!

Climate change: New legal opinion adds more pressure on directors to act

A new legal opinion warns Philippines company directors to take climate change seriously or risk getting in trouble for gross negligence.

Climate mitigation: What Cop27’s failure tells the capital markets

The UN suggests strong policy leadership is vital to shift capital to where it’s needed. Cop27’s failure has just blown that in the water.

The future of sustainability-linked finance in balance

Sustainability-linked debt is growing, but lack of diversity and risk pricing is a concern. Sembcorp’s recent bond is a worry, too.

Privatisation of Twitter: Three ways to engage

Concerned about the social impact of Twitter? Investors may need to look at companies who still have leverage over the platform.

Indonesia: A short window to prove transition plan credibility

Indonesia faces a crucial few months convincing foreign investors to support its ambitious energy transition plan.

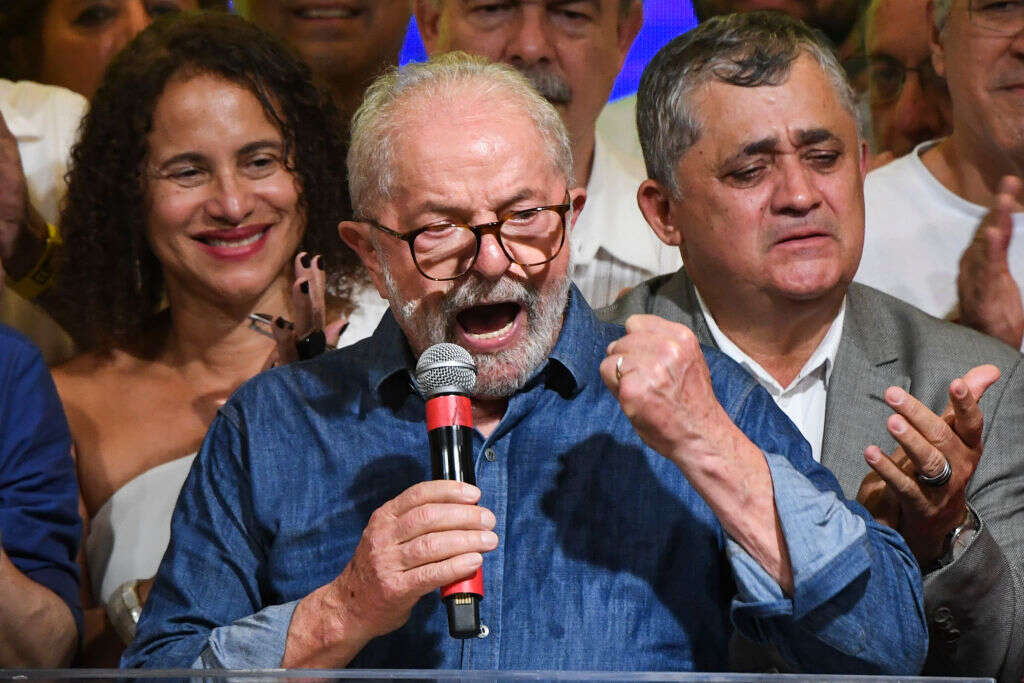

Brazil: Can the banking sector support Lula’s Amazon commitment?

Brazil has a president-elect who wants an immediate halt to deforestation. But will the banking sector be a willing collaborator?

Book review: Transparency will be our saviour

Eric Archambeau, author of Costing the Earth: How to Fix Finance to Save the Planet, sets out his vision on how we can befriend our earth again.

ESG initiatives: Asset owners must sharpen their teeth

If we are to see any meaningful impact from ESG engagement, asset owners need take ESG initiatives they sign up to seriously.

Why HSBC’s response to Kirk’s climate speech was damaging to responsible investment

In a bid to manage the PR fallout from the explosive presentation on climate change by head of responsible investment Stuart Kirk, HSBC’s blunt response may have done more damage to public discourse than his comments themselves.