All articles by Joe Marsh

Booming renewable energy sector faces financing obstacles

Bankers say clean energy needs more policy stability to secure funding in the face of rising market risks, as more investors cut exposure to fossil fuels – in some cases entirely.

Mapfre: “Tsunami” of ESG rules could stymie climate progress

The chief investment officer of Spanish insurer Mapfre says EU regulators’ attempts to supervise sustainable assets are too prescriptive, in that they lack essential interpretative context. This, he adds, is also partly why external ESG ratings fail to add major value.

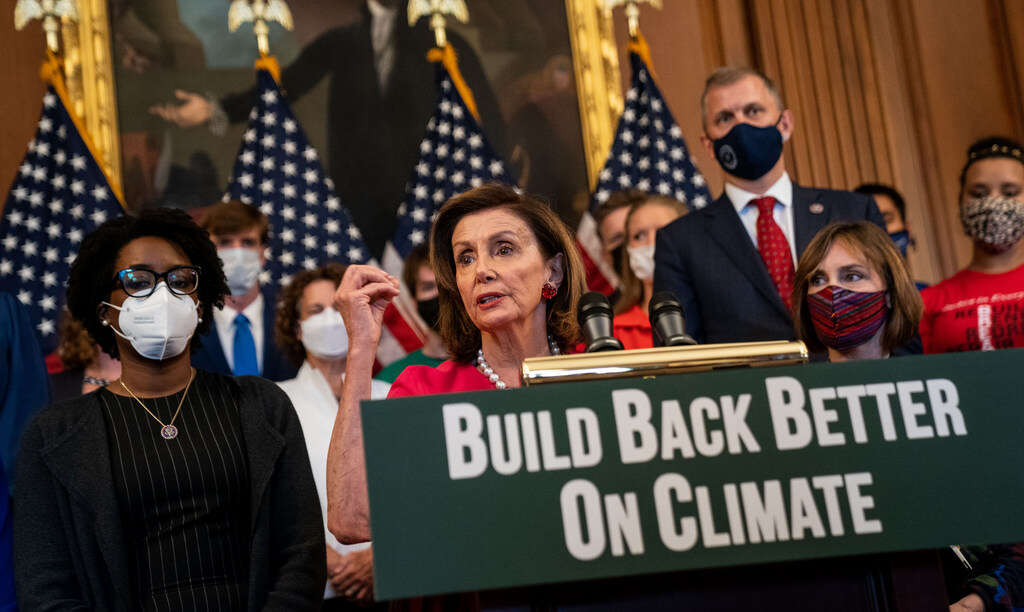

Top pension funds call for climate policy stability

With the US Congress divided over proposed climate and infrastructure bills, and plenty of financial sector opposition to President Joe Biden’s plans, major North American retirement funds stress the need for environmental policy stability.

How investors are refining SDGs to measure impact

Asset owners and managers are becoming more proactive in assessing positive and negative impact in respect of the UN’s Sustainable Development Goals. But some experts feel they can go further.

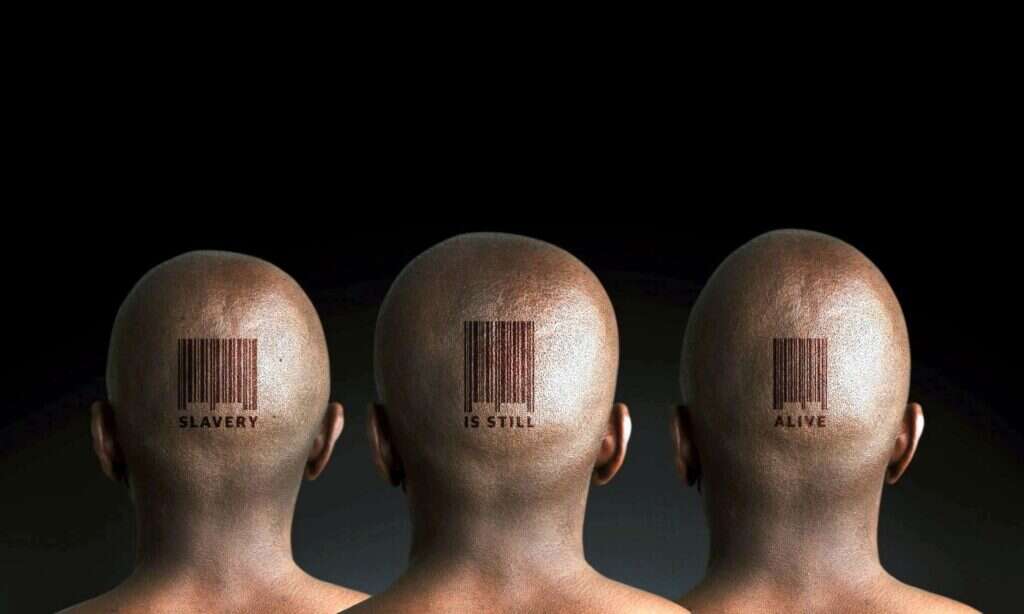

How Australia’s Aware Super is tackling modern slavery

The A$150bn pension fund is using its financial heft to address modern slavery and has developed a risk-assessment tool to support its reporting requirements. But while some asset managers have shown overwhelming support, others are still burying their heads in the sand.

How a top UK pension is building its ESG data architecture

Border to Coast Pensions Partnership, one of the largest British retirement asset pools, is developing its approach to ESG data as it ramps up its focus on private markets, carbon measurement and diversity issues. The institution’s head of internal management gives Capital Monitor the lowdown.

Why a huge drop in ESG assets is not a reason for alarm

As demand for sustainable investing continues its global rise, the corresponding jump in regulation has meant Australia and Europe – among the leaders in this area – have witnessed eligible ESG assets drop dramatically as a proportion of overall assets. Will Canada be next?

Why Norway’s oil fund does not set a carbon reduction target

While it has a long-standing focus on climate risk, the $1.3trn NBIM doesn’t set a specific goal for cutting its portfolio carbon emissions – despite measuring them since 2014. Nor does it want to adopt a climate-adjusted equity benchmark.

Why Norway’s $1.3trn wealth fund prizes transparency so highly

Norges Bank Investment Management owns stakes in some 9,000 companies and seeks to use its huge influence for positive impact. Deputy CEO Trond Grande explains how the fund practises what it preaches when it comes to corporate disclosure.

Behind Canada pension Omers’ carbon footprint analysis

The C$105bn fund has been an early mover in measuring its total portfolio emissions. The head of its sustainability committee talked Capital Monitor through the process and the third parties it works with to achieve it.