- In the latest salvo against the group, investigative journalists from OCCRP, Financial Times, and The Guardian exposed Adani Group’s involvement with offshore funds.

- In mid-August, Deloitte resigned as the accountant for Adani Ports and Special Economic Zone, citing “inherent limitations” of internal financial controls.

- Despite the ongoing controversy, Adani’s green bonds have shown resilience.

It has felt like one of the slowest car crashes in corporate history. Two weeks ago, the Organised Crime and Corruption Reporting Project (OCCRP), a global network of investigative journalists, together with British newspapers the Financial Times and The Guardian published its expose of India’s Adani Group, the world’s largest private developer of fossil fuels.

The report accuses Adani family associates of using offshore funds to invest in Adani Group companies. More to the point, its behaviour has been let slide because of what the report calls the group’s “widely perceived closeness” to Prime Minister Narendra Modi and its “central role” in his plans to develop the country.

“These reports detail a multitude of new allegations and report hard evidence that a web of now named associates of the Adani Group has engaged in deliberate stock price manipulation and thin capitalisation,” Tim Buckley, director of Australian-based independent think tank Climate Energy Finance, wrote on LinkedIn.

“Finally, the loop is closed,” said Hindenburg Research on X, the social media platform formerly known as Twitter.

At the end of January, New York-based US short-seller Hindenburg Research accused the group of what it called the largest con in corporate history and questioned its corporate governance.

Adani has consistently rejected all of these claims. In a statement, it called the most recent charges “yet another concerted bid by Soros-funded interests supported by a section of the foreign media to revive the meritless Hindenburg report”.

Although Adani company shares have traded down over the past week, the latest allegations do not seem to have shaken the company as much as might be expected. On Monday, for example, the shares of holding company Adani Enterprises were showing a weekly decline of only 0.7%.

‘Virtually non-existent financial controls‘

The OCCRP report is in danger of overshadowing more significant news about the company.

In mid-August, Deloitte resigned as accountant of the Adani Ports and Special Economic Zone (APSEZ), the company’s logistics arm.

Although Adani brushed off Deloitte’s departure (“It was agreed to amicably end the client-auditor contractual relationship between APSEZ and Deloitte,” the company said), the accountancy firm has been with Adani since 2017, and its final report appears to be the smoking gun that many have suspected.

It backs up Hindenburg Research’s accusations of “virtually non-existent financial controls” at Adani.

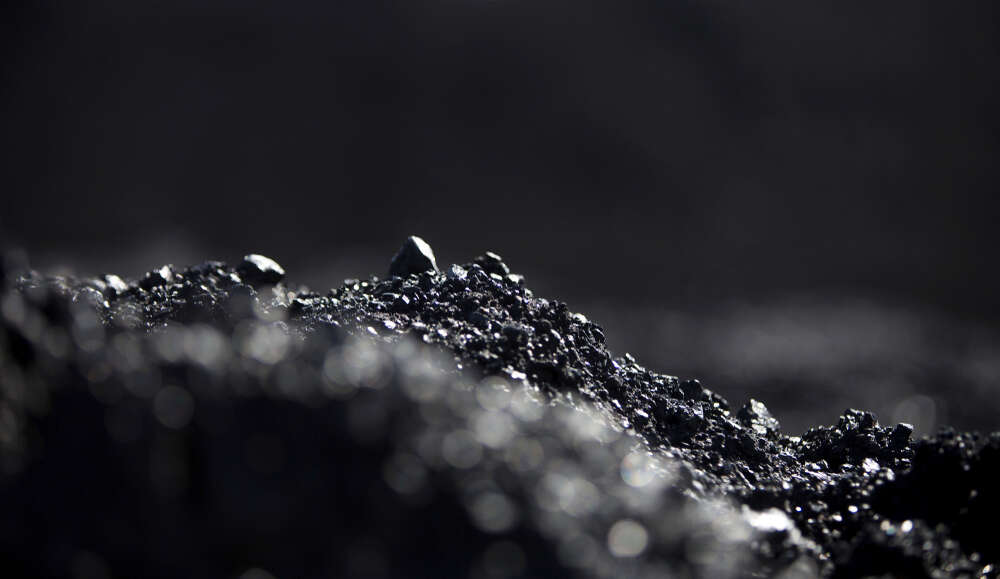

This is a significant claim, as a charge long-levelled at the company is that money raised by one arm of the firm has been used to fund other business units. In particular, the money that has been raised for its green business has been used to fund coal mines.

The accountants complained that Adani had refused an “independent external examination” of the allegations made by Hindenburg earlier this year. The 163-page report discusses the “inherent limitations” of internal financial controls and cites the “possibility of collusion” and “improper management override of controls”.

The Indian market regulator, the Securities and Exchange Board of India (SEBI), has completed its own report on the company, but its findings have not yet been made public.

More to the point, SEBI itself has come under fire as allegations emerged in the Indian press not only that the regulator had been aware of complaints against Adani since 2014, but UK Sinha, SEBI chairman between 2011 and 2017, was appointed independent director of Adani-owned television station NDTV in March.

Investors still quietly held the line

Despite the Adani soap opera, it is important not to lose sight of the fact that the value of the two Adani green bonds has barely wobbled in the secondary market.

Adani Green Energy’s 4.375% 2024 bonds which had traded at distressed levels in February were down only to 92.5 cents on the dollar on Monday morning. It was a similar story at the company’s 6.25% 2024s which were trading at 94.5 cents on the dollar [see chart].

Capital Monitor has relentlessly shone the light on asset managers that have refused to give up their addiction to fossil fuels. As we pointed out at the end of July, the world’s top 30 asset managers have invested $3.5bn in bonds issued over the last 18 months by some 40 companies actively involved in fossil fuel expansion.

They have little impetus to stop investing given the help that the sector is getting from governments.

British politicians have made clear their intention to “max out” North Sea oil, Indonesia has recently indicated its support for new coal-fired power plants, and last week, public policy think tank the Australia Institute pointed out that, since May 2022, the Australian government had approved four new coal mines or expansions that were expected to add 147m tonnes of lifetime emissions.

In March, Adani Group agreed to develop 15GW of renewables over the next few years in Andhra Pradesh and has been looking to the capital markets to fund that expansion. After delaying a bond roadshow at the high of the furore earlier this year, the company is currently looking to raise up to $5bn from the international debt markets in a number of tranches starting this quarter.

Given questions raised by OCCRP and the company’s accountants, in good conscience, no investor should take part. “Hindenburg made Adani a pariah, but many of the company’s overseas investors still quietly held the line,” says Nick Haines, Toxic Bonds campaigner at global consumer watchdog Ekō.

Whether investors develop a conscience now remains to be seen.

[Read more: Governance pushes Adani bonds to junk brink]