S&P’s ESG score call is not the victory the anti-ESG brigade think it is

Getting rid of trivial ESG scores may prove the best thing that’s happened to the development of credit ratings… and…

By

Getting rid of trivial ESG scores may prove the best thing that’s happened to the development of credit ratings… and…

By

As international businesses (mostly) retreat from Russia, the same ethical decision making is not applied to Myanmar’s military junta.

By

Although popular in Japan, a lack of easy definition means transition bonds remain shunned by investors. But signs of clarity…

By

Although banks continue to finance oil and gas activities in the Amazon, companies are realising the financial risks are too…

By

Despite their sustainability claims, think-tank Reclaim Finance finds that asset managers have invested $3.5bn in fossil fuel bonds.

By

As the sustainable bond market matures, Samurai bonds have become a focal point for issuers thanks to low interest rates…

By

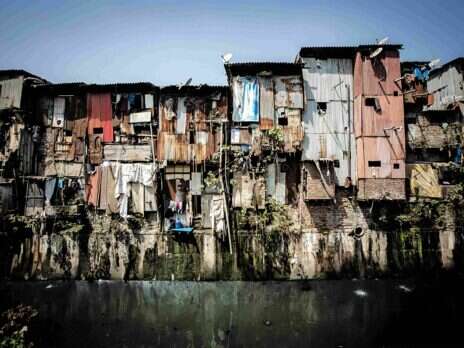

SDG11 proposes to make urban areas inclusive, safe, resilient and sustainable. How are we getting on so far?

By

The fight for biodiversity faces challenges as the TNFD’s draft framework falls short and asset managers continue to neglect their…

By